Tax time’s here again, and whether you’re just starting out or you’ve got a few properties under your belt, it’s worth taking a moment to get everything in order.

Here’s a quick rundown of what you’ll want to have sorted as a property investor heading into EOFY:

1. Income & Expenses

Pull together everything relating to your investment property:

- Rental income

- Agent statements

- Interest on your loan

- Council rates, strata, insurance, water

- Repairs, maintenance, and property management fees

If you’ve done a reno or replaced a hot water system, make sure you know what’s deductible and what needs to be depreciated over time.

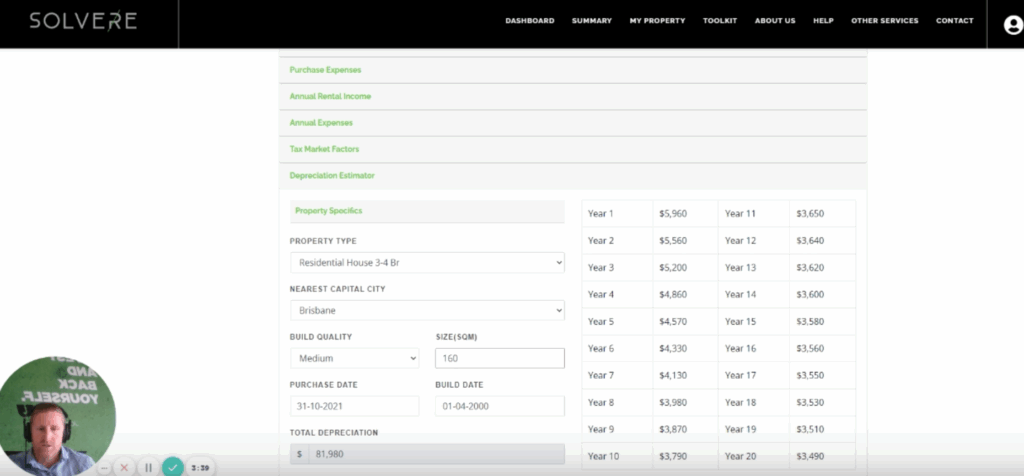

2. Depreciation

If your property is relatively new or recently renovated, a depreciation schedule could save you a fair bit at tax time. If you don’t have one already, it might be worth chatting to a quantity surveyor.

3. Review Your Loan Setup

EOFY’s a good excuse to look at how your loans are structured. Are you making the most of offsets? Are your investment and personal loans clearly split? Small tweaks can have a big impact over time.

4. Work With a Property-Savvy Accountant

Not all accountants are across the detail of property investing. Find someone who understands how to structure things properly, claim everything you’re entitled to, and set you up for the long term.

5. Look Ahead

Tax time’s also a chance to check in on your overall strategy.

- Is your current setup still working for you?

- Are you in a position to buy again soon?

- Do you need to adjust your approach based on cash flow, rates, or life stuff?

Being organised now makes a big difference, and it’s a chance to take control and keep moving forward.

(Need a tool to help get yourself organised for tax time? Check out my Property Analyser Calculator. It takes the risk out of crunching your property numbers and eliminates the fear of the unknown).