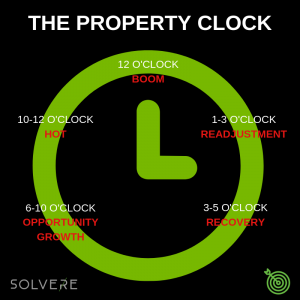

Heard of the Property Clock? Looks easy enough to follow, right? But are you using it properly…

It’s a fundamental investment tool that gives you an idea at which stage of the cycle you should be investing. The average property clock usually represents a 12 to 15 year cycle although smaller cycles appear within this larger cycle.

Most of the time, the general public will buy at 10 o’clock, when the market is HOT.

Not ideal.

By this time, the market has usually experienced most of its growth and purchases are emotionally driven. Which means? BUYERS OFTEN PAY TOO MUCH. The risk is that if the market hits 12 o’clock and then starts to slow down, people can often be settling on property that is now worth LESS than what they’ve paid for it.

And adding insult to injury, the bank and the government are likely to increase interest rates to bring the market back into balance.

This is NOT what we do with our clients.

We look forward. We identify the indicators and drivers in each market, and look for signs pointing towards an upward swing in the market.

Here’s some insight into how I use The Property Clock to get results

- Most of the time our property purchases are made around the 5-7 o’clock mark. We would generally buy trading properties in this mark and this is often where we get our good discounts.

- Quite often, the rents positioned at 7-9 o’clock will do well with add-value strategies such as internal and external renovations.

- 9-12 o’clock is where we get our capital growth.

- We would typically buy a blue chip property, which is generally a newer property in a slightly higher price range, in the 5-7 o’clock mark. Instead of selling a few years after we buy, like we did with our trading properties, we’d sit out the full market cycle, gather our tax benefits and make some gain.

- After watching the market rise to the 2-3 o’clock range, we generally see rents start to increase and catch up with the values. It’s at this point when we assess whether we keep the property to ride out another cycle, or sell.

If you have any questions, or would like to lock in a Clarity Call, reach me via email at john@solverewealth.com.a